Let's face it—money makes the world go 'round, and understanding how to manage it can make a huge difference in our lives. That's where financial literacy steps in, acting like a trusty guide through the jungle of modern finance. In this article, we'll dive into why financial literacy is essential and how you can level up your money skills in a way that's easy, fun, and super practical.

Why You Should Care About Financial Literacy

Imagine you’re planning a road trip without a map or GPS. You might eventually get where you’re going, but not without a lot of wrong turns and wasted time. Financial literacy is like having that map—it helps you make sense of your financial journey, avoid costly detours, and reach your goals faster.

Being financially literate means having the know-how to make smart money choices, whether it’s managing a budget, investing in the stock market, or planning for retirement. It’s not just about avoiding debt (although that's a biggie), but also about feeling confident and secure in your financial decisions. And who doesn’t want a little less stress and a little more peace of mind?

The Struggles of Financial Illiteracy

For many of us, money matters weren't exactly a dinner table topic growing up. This lack of conversation can leave us clueless when it comes to handling finances as adults. Without financial literacy, we might end up with credit card debt we can’t shake off or miss out on investment opportunities that could grow our savings.

Moreover, financial illiteracy can widen the gap between the haves and have-nots. Those in the know can capitalize on financial opportunities, while others may fall prey to high-interest loans or scams.

The Perks of Being Money-Savvy

Being financially savvy comes with a ton of perks. Not only can it help you dodge debt, but it also opens the door to wealth-building opportunities. Imagine having the ability to invest in your future, save for major life events like buying a house, or simply enjoy a guilt-free vacation. Plus, it’s about the freedom to make choices that align with your personal goals.

Tips to Up Your Financial Game

Ready to up your financial game? Here’s how to get started:

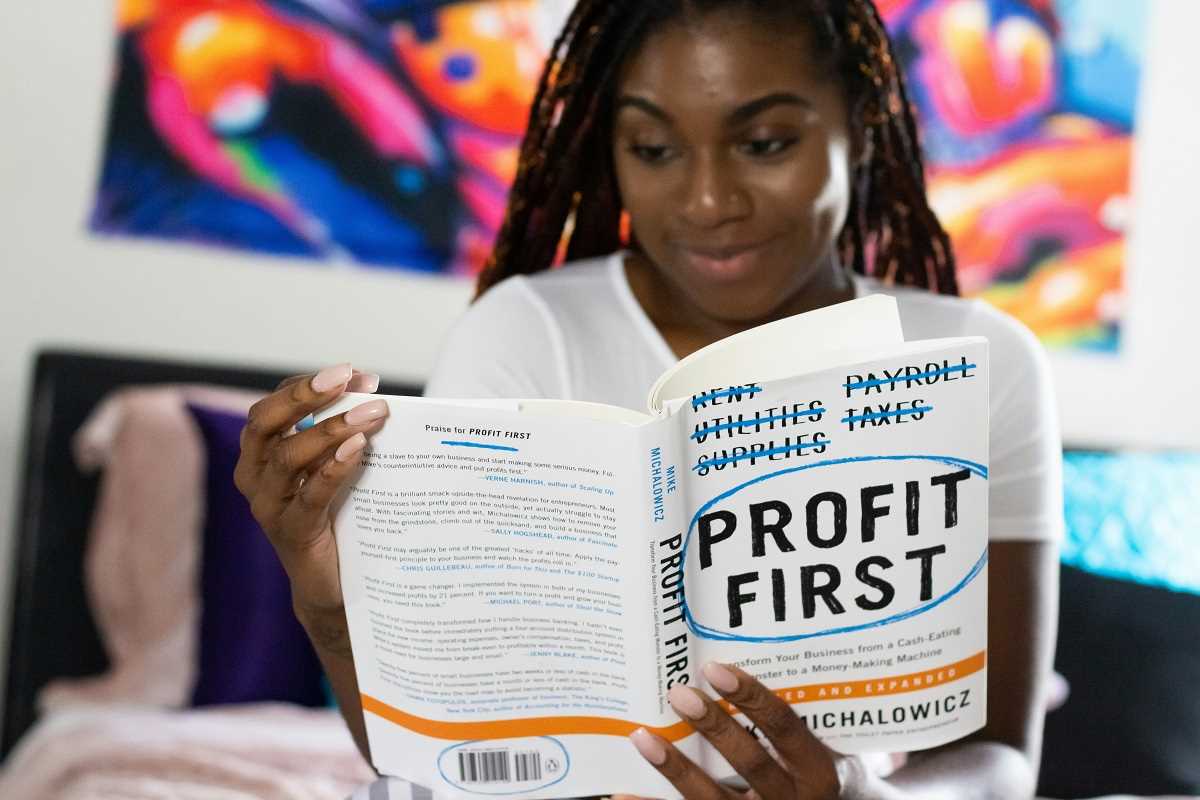

- Dive into Learning: There are tons of resources out there, from online courses to books and podcasts. Check out sites like Khan Academy for free lessons or dive into a personal finance book like "Rich Dad Poor Dad."

- Budget Like a Pro: Start tracking where your money goes each month. Apps like Mint or YNAB (You Need A Budget) make it easy-peasy. You’ll be surprised how much more you save when you know where it’s all going!

- Start Small with Investments: Investing can be daunting, but start small with something like index funds. They’re low-risk and give you a taste of how the market works.

- Set Goals and Plan: Whether it’s saving for an emergency fund or planning a dream vacation, having clear goals can keep you motivated. Break it down into manageable steps so it doesn’t feel overwhelming.

- Talk to the Pros: If you’re feeling stuck, don’t hesitate to chat with a financial advisor. They can give personalized advice tailored to your situation.

- Join the Conversation: Engage in financial discussions, whether it's with friends, family, or online communities. Sharing experiences and tips can be incredibly insightful.

Let's Get Started!

Remember, becoming financially literate isn’t about learning everything overnight. It’s a marathon, not a sprint. Start taking small steps today—read an article, set a budget, or talk to a friend about their financial journey. Each step you take brings you closer to mastering your money and achieving financial freedom.

So, what are you waiting for? Let’s make money work for you, not the other way around. With a little effort and curiosity, you can turn financial literacy from a daunting concept into a powerful tool for your future.

(Image via

(Image via