Financial stress can weigh heavily on individuals, affecting their overall well-being and quality of life. However, by implementing practical strategies, you can manage this stress effectively and gain greater control over your finances. Below are actionable tips to help you reduce financial stress and work towards a more secure financial future.

Create and Stick to a Budget

One of the most effective ways to reduce financial stress is to create a budget and adhere to it. Start by outlining your income and expenses to understand where your money is going each month. This process can help you identify spending patterns and areas where you might cut back.

Develop a budget that allocates funds for essential expenses, savings, and discretionary spending. By sticking to this budget, you can better manage your money, avoid overspending, and increase your savings. Research indicates that individuals who regularly budget are more likely to achieve their financial goals and experience reduced financial stress.

Build an Emergency Fund

Another essential strategy is to build an emergency fund. This fund acts as a financial safety net, providing peace of mind and helping you handle unexpected expenses without resorting to high-interest loans or credit cards. Aim to save at least three to six months’ worth of living expenses in a readily accessible savings account.

Having an emergency fund can prevent financial setbacks from disrupting your long-term plans. It offers security and helps you stay on track even when unforeseen circumstances arise. Studies show that people with emergency savings are less likely to experience financial stress and are better prepared for financial emergencies.

Prioritize Debt Repayment

Managing and prioritizing debt repayment is crucial for reducing financial stress. High-interest debt, such as credit card balances, can be a significant source of financial strain. Focus on paying off these high-interest debts first while continuing to make minimum payments on other debts.

As you reduce your debt, you free up more of your income for savings and investment. Lowering your debt load can also improve your credit score and overall financial health. Effective debt management can lead to reduced financial stress and a clearer path towards financial stability.

Invest in Financial Education

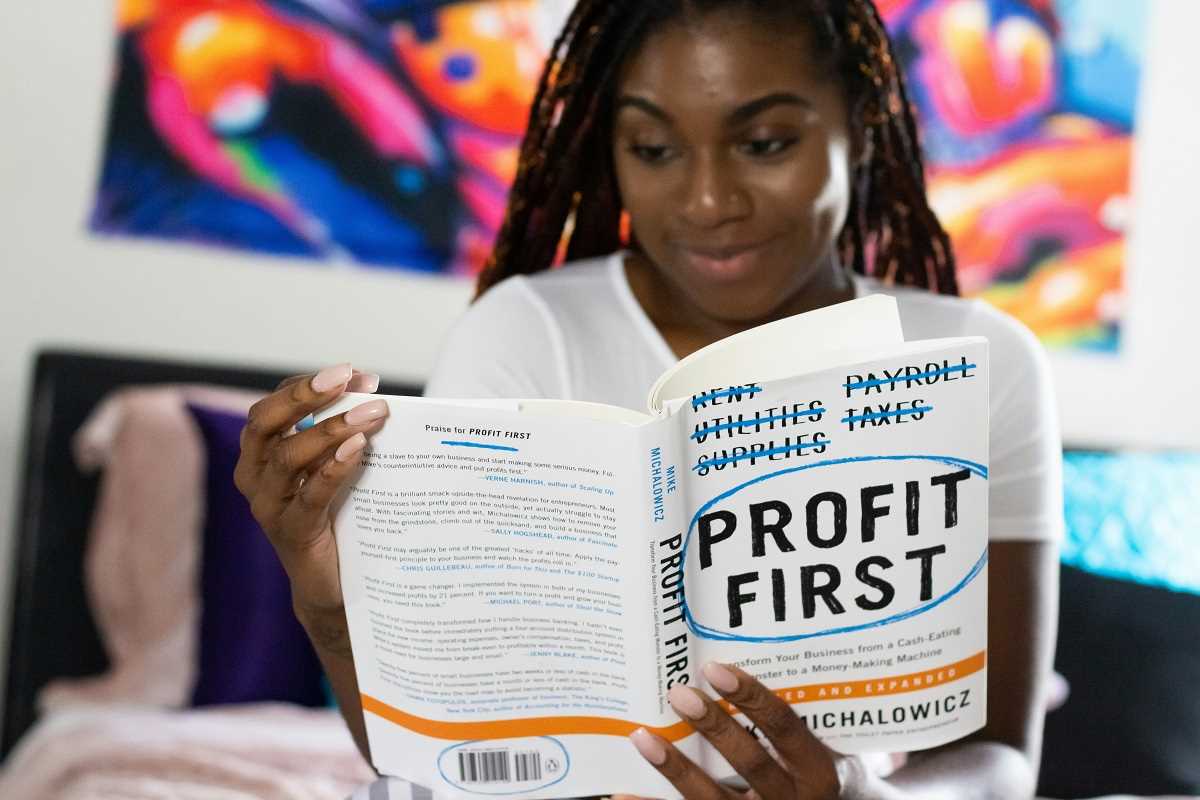

Increasing your financial literacy is a powerful way to reduce financial stress. By educating yourself about personal finance topics—such as investing, retirement planning, and insurance—you can make more informed decisions and feel more confident about your financial future.

Consider taking online courses, attending workshops, or reading books on personal finance. Research has shown that individuals with a higher level of financial literacy are more likely to make sound financial decisions and achieve long-term financial security. Investing in your financial education can provide you with the tools needed to manage your finances effectively.

Practice Mindful Spending

Adopting mindful spending habits can also alleviate financial stress. Before making a purchase, evaluate whether it aligns with your values and long-term financial goals. Mindful spending encourages you to consider the necessity and impact of your purchases.

This approach can help you avoid impulse buying, prioritize spending on what truly matters, and reduce overall financial anxiety. By being intentional with your spending, you can achieve greater satisfaction with your purchases and maintain a more balanced financial outlook.

Seek Professional Advice

If you’re struggling to manage your finances or make complex financial decisions, seeking support from a financial advisor or counselor can be beneficial. A financial professional can offer personalized guidance, help you set achievable financial goals, and provide strategies to improve your financial situation.

Working with a financial advisor can help you develop a comprehensive financial plan, stay accountable, and make informed decisions. Research indicates that individuals who work with financial professionals often experience better financial outcomes and reduced stress related to their finances.

Implementing these practical strategies can help you effectively manage financial stress and work towards a more secure financial future. By creating and sticking to a budget, building an emergency fund, prioritizing debt repayment, investing in your financial education, practicing mindful spending, and seeking professional advice, you can take meaningful steps towards improving your financial well-being.

Remember, achieving financial security is a gradual process that requires patience and persistence. Incorporate these tips into your financial routine to gain more control over your finances and reduce stress, leading to a more stable and fulfilling financial future for yourself and your loved ones.